Loss modeling to drive insurance premiums determination

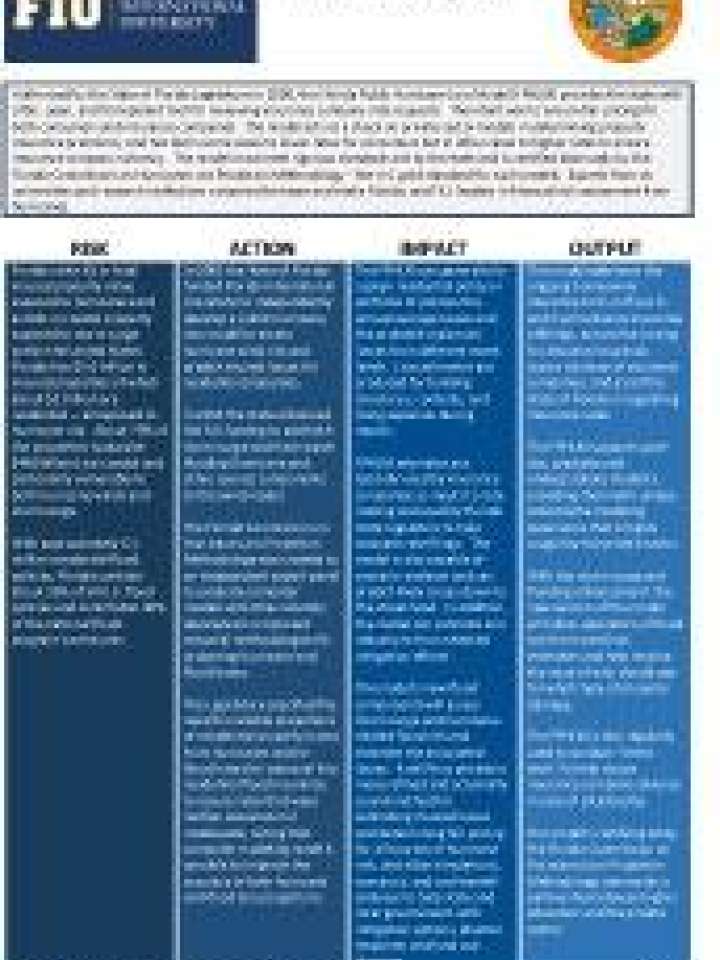

Authorized by the State of Florida Legislature in 2000, the Florida Public Hurricane Loss Model (FPHLM) provides the state with a fair, open, and transparent tool for reviewing insurance company rate requests. The intent was to ensure fair pricing for both consumers and insurance companies. The model acts as a check on private sector models in determining property insurance premiums, and has led in some cases to lower rates for consumers but in other cases to higher rates to ensure insurance company solvency. The model must meet rigorous standards set by the state and is certified biannually by the Florida Commission on Hurricane Loss Projection Methodology - the U.S. gold standard for such models. Experts from six universities and research institutions comprise the team and make Florida, and FIU, leaders in financial risk assessment from hurricanes.