Financing prevention

Financing prevention and de-risking investment

Total insured losses from natural hazards and human- induced disasters in 2023 was estimated at $291 billion. Indirect socio-economic costs of disasters are many times greater. And we have only a scant understanding of the damage to and losses of ecosystems as a result of disasters.

Yet, in certain countries, domestic public finances earmarked for risk prevention as primary objective are on average less then 1% of national budgets, suggesting a chronic underinvestment in disaster risk reduction.

Challenges

Current actions are not commensurate with the sheer scale of the challenge – the rapid accumulation of disaster risk that is systemic, interconnected and cascading. Actions to reverse this trend are needed if governments want to achieve the outcome and goal of the Sendai Framework for Disaster Risk Reduction 2015-2030 efficiently and effectively.

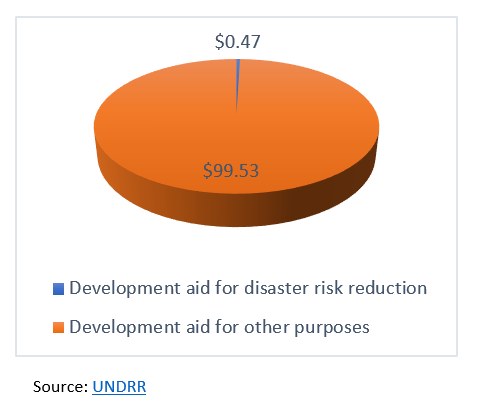

For every $100 spent on total development aid between 2010-2018, as little as 47 cents were allocated for disaster risk reduction.

Between the period 2005 to 2017, $137 billion was provided in development assistance related to disasters, wherein $9.60 out of every $10 was spent on emergency response, reconstruction, relief, and rehabilitation; while less than 4%, $5.2 billion, was invested into disaster prevention, mitigation and preparedness.

Disaster resilience is not prioritized because it is wrongly perceived as politically risky – a cost for an event that might never happen within a political term in most cases driven by lack of visible and well communicated incentives. We are stuck in a vicious circle where the financial cost of disasters is rapidly rising, strapping governments in their ability to mobilize and provide necessary funds, trapped in the vicious and self-fulfilling cycle of disaster-response-recover-repeat. Although there has been substantial progress in upgrading investment into ex-ante risk reduction over the last few years, there is still a serious bias towards reliance on ex-post response, reconstruction and rehabilitation.

Many governments, businesses and financial institutions of all shapes and sizes often do not regularly incorporate considerations related to their exposure and vulnerabilities to the range of hazards identified by the Sendai Framework in their financial decision-making.

Investing in prevention mitigates loss

Global investments of €1.6 trillion in appropriate disaster risk reduction strategies could avoid losses of €6.4 trillion.

Investing in disaster risk reduction is a precondition for developing sustainably in a rapidly changing climate. The policy space is at a crossroads. Faced with an increasingly tight fiscal space and existential dilemmas over whether to continue allocating scarce public resources to immediate relief or to invest in disaster risk reduction, including in more inclusive sustainable recovery efforts, political leaders discussing development finance in the era of COVID-19 have recognized the value of investing in ex-ante disaster risk reduction to bridge the short term with the long term, whilst addressing climate change and ensuring overall sustainability. But this requires a whole mindset shift to take place across the financial system, that is a move from short-term outlook and under-prioritizing disaster risks to promoting a ‘Think Resilience’ approach that becomes mandatory in all public, as well as private sector investments.

How investing in prevention mitigates losses

- In low- and middle-income countries, investing in more resilient infrastructure yields US $4 in benefit for each $1 invested.

- Just 24 hours warning of a coming storm or heat wave can cut the ensuing damage by 30 percent. Spending US $800 million on such systems in developing countries would avoid losses of $3–16 billion per year.

- Investing in resilience can foster economic growth and employment. Every $1 million invested in climate adaptation infrastructure in the construction sector creates close to 650 jobs in India, 200 in China, 160 both in Brazil and in Indonesia, and 120 in the Russian Federation.

- Climate services investments overall have a cost benefit ratio of one to 10.

- Securing water for our societies by 2030 could cost just over 1% of global GDP - about 29 cents per person, per day from 2015-2030.

- Mangrove forests provide more than $80 billion per year in avoided losses from coastal flooding - and protect 18 million people.

More about the Business case for DRR

Call to action

Shift investment decisions and increase financing for risk prevention.

1. Overhaul regulatory environment and strengthen oversight

- Mainstreaming of disaster risk into public and private investment: National governments and regulators need to define sustainable, disaster resilient investments and encode risk metrics into broader investments to change investor behavior and raise awareness of disaster risks.

- Ensure financial institutions and banks align their strategies, operations and activities with the Sendai Framework: Central banks and financial supervisors, including auditors, need to integrate sustainability, all potential hazard impacts including related environmental, technological and biological hazards and risks, consistent with the Sendai Framework, into financial stability monitoring and financial supervision.

- Create an enabling environment for effective insurance: Not only can the insurance sector increase the protection gap; if engaged appropriately, through regulatory changes, it could also invest in risk prevention and resilience building, prevent amassing of debt due to disasters and reduce costs of insurance.

2. Build the evidence base

- Track prevention financing: Tracking financing flows in risk prevention as well as other fiscal data would support in identifying the volume of investment utilized out of the budgeted allocation and more importantly how much of it reaches the intended goal or beneficiary action.

- Conduct risk-sensitive budget reviews: For holistic and financially sustainable management of disaster risk, a portfolio of risk reduction investments needs to be developed that considers all the phases of the risk management cycle.

- Increase use and application of risk and financial data: While there have been many efforts to collect and provide open access to hazard risk, exposure and vulnerability data, and data on losses caused by disasters associated with natural and human-induced hazards, its use and interconnection with financial decision-making could be significantly expanded.

3. New and innovative funding models

- Promote blended financing and introduce prevention in bonds: Innovative financing models such as blended finance and impact investing have emerged as one of the tools for addressing risks and encouraging the private investments that can transform people’s lives and contribute toward the Sendai Framework implementation. Another opportunity is to introduce prevention as a key criterion in climate- resilience bonds, green bonds, social and sustainability linked bonds that would help in leveraging finance for prevention, adaptation and mitigation actions.

- Establish a pipeline for disaster and climate resilient infrastructure investment: Co- benefits, bankability and pipelines of infrastructure projects supported by strong commitment of national governments and regulators will drive markets’ interest and foster stronger partnership between public and private sector.

- COVID-19 Stimulus package to build resilience: COVID-19 and complex disasters have highlighted the need for more investment in ex-ante resilience and the economic stimulus packages are an opportunity to address multiple risks, including climate change impacts.

Publications

"For a growing number of populations around the world, facing a future of more frequent and extreme disasters will only be possible if more funding is channelled towards adaptation and disaster risk reduction."

— Mami Mizutori

Videos

Further reading